The June 2023 Mastermind Collegium, or MMC, has come and gone, marked by a talented group of speakers and guests that descended upon Cleveland, Ohio. The venue was the gorgeous Hilton Cleveland Downtown that showcased views of C2P’s home city to all the financial advisors and their teams who attended. Here is just some of the excitement from the three-day adventure.

A Woman’s Clarity Mixer Sponsored by Allianz

They came, they sipped, they celebrated. Advisors and their teams toasted to A Woman’s Clarity, C2P’s newest podcast created by Kirsten Schlumbohm, Vice President of Insurance & Sales, that focuses on the unique financial needs of women clients and how to better serve them.

There were signature cocktails on hand as Schlumbohm and special guest Natasha Schulze, Sr. External Wholesaler at Allianz Life, spoke about how financial services professionals can and should support female clients.

Welcome to Cleveland!

The first evening, the foyer was packed with the financial industry’s top talent networking and catching up since C2P’s last big event. There were delicious snacks and drinks, live music, and Jim Morris, former youth coach and MLB pitcher behind Disney’s “The Rookie,” signed autographs and chatted up attendees.

Morris then kicked off the following day’s events with a presentation where he delivered some poignant lessons on finding your mentors, harnessing your purpose, and following your dreams.

Updates & Innovations from C2P’s Heroes

Three main leaders at C2P teamed up clad in superhero costumes to outline what advisors can expect on the horizon from the organization responsible for the Mastermind Collegium. Jason L Smith, CEP®, BPC, Founder and CEO; Dave Alison, CFP®, EA, BPC, President and Founding Partner; and Matt Seitz, Chief Marketing Officer and Partner, each spoke to what’s new and next at C2P, including that Alison was recently named to the 40 Under 40 list by InvestmentNews.

Let Go & Lead with Gina Pellegrini

Owner of Strategic Coach as well as Pellegrini Consulting, Gina Pellegrini shared her expert process and logic behind fine-tuning one’s management style to foster a better work environment. Her methods outlined the importance of empowering employees, boosting accountability, and ensuring positive communication and cooperation within a financial advisor’s firm.

Team & Client Service Track Sessions

These breakouts were invaluable to helping team members learn from each other to stay organized and on track to further their success.

Led by Jennifer Mackert, Chief Operating Officer and Partner at C2P, Gina Pellegrini, Matt Seitz, and others, these activities and lessons included:

- The importance of having a process for qualifying leads and converting them to prospects

- Project planning tools to increase efficiency, organization, and streamline one’s offices

- Guidance on successful calling practices to secure more business

- Communication best practices, including weekly reports and a meeting structure format

- Marketing strategy Q & A that covered everything from social media to artificial intelligence (AI)

Mastermind Groups

Guests were able to create a mastermind group with others in similar roles that can help them meet their goals. Advisors and paraplanners teamed up with others in one session, and client service representatives and other team members gathered in another session — all exchanged ideas and created a plan to follow and check-in with each other. These mastermind groups offer a unique opportunity for top financial industry talent to support each other’s development.

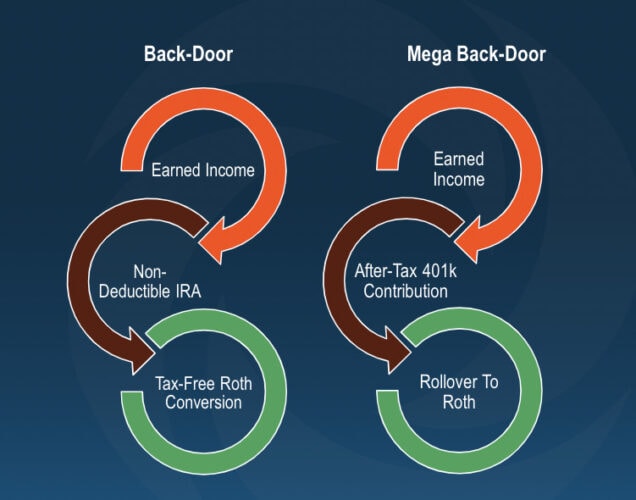

Tax Management, The Bucket Plan®, and Beyond: Special Topics

Guests took advantage of grab-and-go drinks on their way to hear from a powerhouse of speakers, each covering a unique point of view. These included:

- 3 Step Annual Review — Tim Clairmont CFP®, MSFS™, President and CEO of Clear Financial Partners.

- Lead with Tax Management to Turn High-Net-Worth Prospects into Clients — Glen Pier, CFF, President of Infinity Wealth Management.

- The Bucket Plan® 2.0 Innovations — Joe Bilello CFF, CHFC®, CEP®, of Avanti Wealth & Tax Management.

- Top Advisor Showcase of Joe Salerno — how he has maintained success at Salerno Financial Group and the core values that inform his work.

A Night Out in “The Land”

After a long day, attendees were able to unwind and rub elbows on the water at Lindey’s Lake House in Cleveland’s Flats East Bank entertainment district. Advisors and the C2P crew alike took part in dressing up to support the local charity Superheroes to Kids in Ohio. While a DJ played in the background, guests ate and sipped along the Cuyahoga River until dark.

Values-Based Financial Planning with Bill Bachrach, CSP, CPAE

The final day of the MMC, lead advisors and paraplanners participated in a specialized training with Bill Bachrach, author and creator of AdvisorRoadmap. Bachrach spotlighted the role of character, competence, values, and trust when it comes to being a better financial advisor. He also detailed a step-by-step process when walking clients through the Bucket Plan® that includes when and how to get paid for one’s services.

SuperAdvisor Panel

Top industry performers assembled onstage as Jason L Smith highlighted their successes from the past year. John Del Greco, President/Owner of Del Greco Group Tax & Wealth Management topped the list, followed by Dave Alison, leader of Alison Wealth Management; Bryan Bibbo, AIF®, of JL Smith Wealth & Tax Management; and Jeannette Bajalia, President and Founder of Woman’s Worth®. Each advisor shared their insights and individual strategies on how they sustained growth.

Marketing Closes the Mastermind Collegium

To finish out the MMC, Matt Seitz took guests through a marketing roundup, first with a presentation that homed in on why it’s critical as an advisor to integrate sales into the marketing process. Seitz explained how doing so ensures quality leads never fall through the cracks so an advisor can fully capitalize on all marketing channels.

Then, Seitz sat down with a panel of C2P’s “marketing superheroes,” or advisors harnessing the power of marketing and seeing concrete results. Whether it’s a host of solid leads, new business in their practices, higher rankings on Google’s search results, and more, these advisors were recognized because they’re embracing and implementing marketing best practices. The panel consisted of:

- Gary Pelfrey, Director of Business Development for JL Smith

- Glen Pier, CFF, Infinity Wealth Management

- Greg Hammer, CEO/President, Hammer Financial Group

Another Groundbreaking MMC Down — Until Next Year

The 2023 Mastermind Collegium in Cleveland was the highest attended C2P MMC to date, and the first to include advisors’ trusted staff. C2P consistently evolves to better serve financial advisors by building our offerings, infrastructure, and capacity. With our help, advisors can thrive and focus on what matters — being there for their clients. Plus, we make sure it’s not all work and no play with fun events like the MMC.

Don’t miss out on the dynamic support, training, turnkey processes, and more we can provide you as an advisor.

If you’re curious about our future MMCs, contact us today or schedule a 20-minute complimentary consultation with one of our talented team members to learn more about working with C2P!