We have sent your booking information to your email address.

Women face particular challenges when it comes to navigating the world of financial planning and investing with confidence, whether caused by behaviors more common to them or the way the wealth management industry has historically perceived them. However, with women poised to be on the receiving end of a massive generational wealth transfer in the years to come, advisors need to make sure they are connecting with and supporting their women clients in ways they have not done before. That’s where behavioral finance can help.

Behavioral finance is a branch of economics that studies how psychology influences financial decision making. It recognizes that our emotions, biases, and cognitive factors motivate people to make choices when it comes to managing their money. This intersection of psychology and financial services also explores concepts such as loss aversion, overconfidence, and herd mentality, all of which can impact a client’s financial outlook.

In an episode of A Woman’s Clarity podcast, Daniel Crosby, Ph. D., Chief Behavioral Officer at Orion Advisor Solutions, told Kirsten Schlumbohm, Vice President of Annuity Sales at C2P, that there are many ways women have been misunderstood by the financial services industry, despite them often outperforming men in investing, and that those should change. “The way our industry has tried to approach women about investing and money, I think a lot of times it’s patronizing, it’s kind of pink-washed … and so we should be speaking to women and meeting them where they’re at, which is in high places.”

Women face a unique set of challenges in the financial realm. Historical and societal factors have contributed to disparities in confidence and participation. Additionally, research over the years suggests that women may exhibit different behavioral biases compared to men. These biases can include being more risk-averse and seeking more education and information before making decisions.

According to Fidelity’s 2021 Women & Investing Study*:

Financial advisors play a crucial role in educating their female clients about financial concepts, investment options, and the importance of long-term planning. By providing comprehensive and tailored financial education, advisors empower women to make informed decisions and take an active role in managing their finances.

Financial advisors who are skilled at recognizing behavioral biases of their clients can be better fiduciaries. By understanding their women clients’ decisions on a more personal level, advisors can help them feel more confident in their financial plan and investment strategies.

By helping women establish goals and using a holistic financial planning process, advisors can create a roadmap for their success. Working with women clients to explain and develop personalized financial plans that consider risk tolerance, time horizons, and income streams, aligning investments with these goals.

When women clients feel like they have a trusted financial representative, this is reassuring during times of market volatility, helping them stay focused on their long-term wealth objectives. Financial advisors should provide ongoing support for their women clients, guiding them through market fluctuations and create a customized investment portfolio they can feel confident about.

Effective communication is key to the advisor-client relationship. Financial advisors should take extra time to understand their female clients’ unique circumstances, values, and concerns. Kirsten Schlumbohm added that it’s important for financial advisors to come into meetings with their women clients with open ears and create a safe, inclusive environment. “Women want to be heard, they want to be educated, they want you — the advisor — to come to the table they’ve set, not one that’s been set for them,” Schlumbohm said.

When financial advisors employ aspects of behavioral finance to understand, connect with, and serve their women clients, those clients feel more confident in their overall wealth plan and engaged in the process. By educating, guiding, and listening, financial advisors can better help women build a more secure financial future and feel empowered in doing so.

Financial Professional Use Only

The information provided in this presentation is not intended as investment advice or legal advice. The information provided is for informational and training purposes only. The information in this presentation was accurate as of the time the material was created. Tax laws and rulings can frequently change. Please discuss the client’s current situation with an accountant or tax advisor.

Thank you for your interest in C2P!

A C2P team member will reach out on the date and time you selected. You can also contact us directly via phone or email.

C2P Enterprises

30400 Detroit Road, Suite 201

Westlake, OH 44145

(888) 240-1923

ahenson@c2penterprises.com

C2P Enterprises consists of four individual companies that share one vision: improving the lives of American families through holistic financial planning. Prosperity Capital Advisors is an SEC Registered Investment Adviser (RIA) that provides financial planning and holistic wealth management solutions to investment advisors and clients nationwide. Valor Capital Management is an SEC Registered Investment Adviser operating as a portfolio strategist and turnkey asset management program. Clarity Insurance Marketing is a best interest-focused insurance marketing organization that facilitates product screening, selection, and support for all lines of fixed insurance products. Clarity 2 Prosperity is a financial training, coaching, and IP development organization committed to simplifying financial planning for financial advisors while helping them understand best practices for integrating investment and insurance solutions in a single, holistic plan. Collectively, these organizations provide advisors the training, resources, products, and tools to successfully grow their independent advisory firm while serving in the best interest of each of their clients.

Thank you for your interest in C2P! Please fill out the form below to learn more about working with us. A C2P team member will be in touch with you very shortly. You can also contact us directly via phone or email.

C2P Enterprises

30400 Detroit Road, Suite 201

Westlake, OH 44145

(888) 240-1923

C2P Enterprises consists of four individual companies that share one vision: improving the lives of American families through holistic financial planning. Prosperity Capital Advisors is an SEC Registered Investment Adviser (RIA) that provides financial planning and holistic wealth management solutions to investment advisors and clients nationwide. Valor Capital Management is an SEC Registered Investment Adviser operating as a portfolio strategist and turnkey asset management program. Clarity Insurance Marketing is a best interest-focused insurance marketing organization that facilitates product screening, selection, and support for all lines of fixed insurance products. Clarity 2 Prosperity is a financial training, coaching, and IP development organization committed to simplifying financial planning for financial advisors while helping them understand best practices for integrating investment and insurance solutions in a single, holistic plan. Collectively, these organizations provide advisors the training, resources, products, and tools to successfully grow their independent advisory firm while serving in the best interest of each of their clients.

Thank you for your interest in C2P! Please fill out the form below to learn more about working with us. A C2P team member will be in touch with you very shortly. You can also contact us directly via phone or email.

C2P Enterprises

30400 Detroit Road, Suite 201

Westlake, OH 44145

(888) 240-1923

C2P Enterprises consists of four individual companies that share one vision: improving the lives of American families through holistic financial planning. Prosperity Capital Advisors is an SEC Registered Investment Adviser (RIA) that provides financial planning and holistic wealth management solutions to investment advisors and clients nationwide. Valor Capital Management is an SEC Registered Investment Adviser operating as a portfolio strategist and turnkey asset management program. Clarity Insurance Marketing is a best interest-focused insurance marketing organization that facilitates product screening, selection, and support for all lines of fixed insurance products. Clarity 2 Prosperity is a financial training, coaching, and IP development organization committed to simplifying financial planning for financial advisors while helping them understand best practices for integrating investment and insurance solutions in a single, holistic plan. Collectively, these organizations provide advisors the training, resources, products, and tools to successfully grow their independent advisory firm while serving in the best interest of each of their clients.

Your priorities as a financial advisor are forming relationships with clients and ensuring they can reach their unique wealth management goals. The most successful advisors don’t just do that well. They excel, and C2P helps mold those advisors every day.

Hear from Co-Founder and President Dave Alison, CFP®, EA, BPC. He explains who we are at C2P and what we do for the advisors who work with us.

Simplify Your Planning, Increase Your Closing Ratio

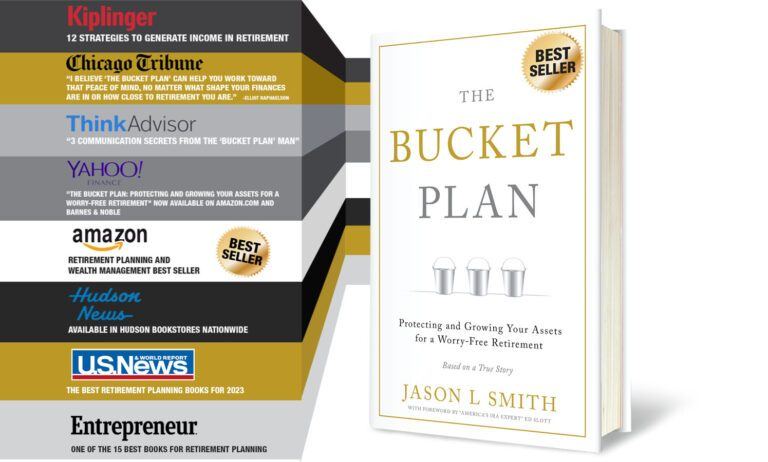

Built around our best-selling book, “The Bucket Plan: Protecting and Growing Your Assets for a Worry-Free Retirement,” we offer a holistic, proven process that simplifies financial planning for you and your clients. Through a combination of training sessions, coaching and templates, you’ll be able to take key steps:

Differentiate Your Business Through Taxes

A comprehensive tax system can set your firm apart from other wealth management providers. That’s why we offer a three-pronged approach — tax planning, tax management and tax preparation — to attract and retain high-net-worth clients.

In addition to our most popular training course, the Tax Management Journey®, we provide more tax-based education and tools that help expedite your growth.

Build Your Business Your Way

Picture a day when your firm is profitable without your production. Whether you’re just starting out on this journey or well on your way, we want to help you!

The Teamwork Movement, formerly The Advisor Career Path & Compensation Program, helps your firm continue running successfully and eases your mind regarding legacy and succession planning. It helps you attract, retain and reward top talent. As a result, you bring on the best people and adequately invest in them for your business’s future.

Turnkey processes for converting prospects to clients

Clear, focused and trackable marketing strategies

A multifaceted investment platform that includes some of the world’s largest institutional asset managers, like Blackrock, Vanguard and Dimensional Fund Advisors

A nationwide network of highly skilled industry professionals to support you

Training and resources to help you grow your skill set and nurture top talent